Bellies Are The Star Of The Show.

What have you done lately to boost cutout values?

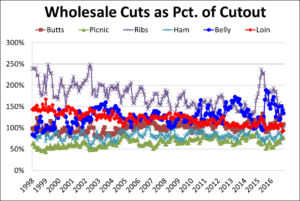

No matter how you slice them, loins and spareribs are problems; bellies are the star, and butts, picnics and hams have basically held steady as contributors to the cutout value. Steve Meyer | Mar 06, 2017

The value of a hog is determined, of course, by the total value that all of its parts will garner in downstream uses. Sometimes those downstream values make a positive impact and sometimes they don’t help so much. All downstream values are susceptible to short-term anomalies, but they usually follow some long-term patterns. Let’s consider a few important ones and what they mean for the industry.

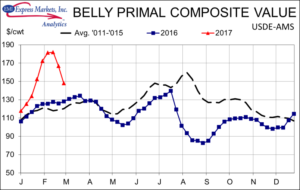

Much has been made of the value added recently by the belly wholesale cut in recent weeks, and the attention is indeed well deserved. Belly prices began increasing in December. That timing is remarkable for two reasons. First, it rarely happens in December as the historic seasonal trend is flat at best and usually downward. Second, the rally began after monthly records for slaughter and pork production in September, October and November and just as a soon-to-be-record-large December had commenced.

Stocks of frozen bellies had declined slightly in November, a month in which they usually gain about 15 million pounds. They fell slightly again in December, a month in which they usually gain another 15 million pounds. They declined again in January! Belly usage was, to say the least, robust this winter.

As belly inventories tightened, the belly primal value exploded from roughly $1 per pound in early December to over $1.80 in early February. Skin-on bellies eclipsed $1.90. Derind bellies went above $2.20. The increase in bellies prices added roughly $13 per hundredweight to the cutout value at their peak. About half of that value has been lost as of last week, but the bump was helpful for both packer and producer bottom lines.

While recent usage has been spectacular and led to a sharp short-run increase in prices, this is really nothing new. Bellies prices have been improving for many years as much higher quality bacon has become a condiment on many, many sandwiches and has benefited from significant attitude changes relative to animal fats and flavor. As can be seen with the bright blue line in this chart, bellies as a percent of the cutout have been volatile in the past few years, but the trend is still upward.

“What happened to ribs?” you might ask. Except for a 2015 surge, that price has been trending decidedly lower. The primary reason is that spareribs have gotten bigger and end-users have pushed per-unit prices lower to control the plate cost of ribs in restaurants. Though their price is lower, the impact is small since spareribs account for only about 4.5% of the cutout value.

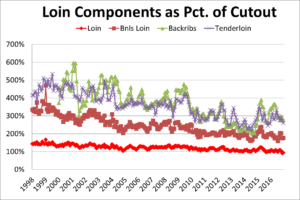

The much larger issue is the red line in the chart — loins. They account for just over 25% of the cutout value, and their value has relentlessly declined. But just as the cutout value is driven by the value of the component cuts, so wholesale cut values are driven by the value of sub-primal cuts. The chart below shows loins (again the bright red line) as a percentage of the cutout value and the three primary components of loins, also as a percentage of the cutout value. I expected the sharp decline for boneless loins as that agreed with my long-held opinions (perhaps biased, I admit) that muscle quality has been an albatross for loin values. But the relative values of the other two primary components, back ribs and tenderloin, have fallen as well. To defend my opinion/bias, I will point out that the percent of cutout for boneless loins has fallen by 46% from 1998 to 2016 while those of back ribs and tenderloin have fallen by only 32% and 35%, respectively.

No matter how you slice them, loins and spareribs are problems; bellies are the star and butts, picnics and hams have basically held steady as contributors to the cutout value. I’m not sure much can be done about spareribs short of making hogs much smaller, but a new commitment to muscle quality will almost surely help loins and tenderloins. While consumers may be more tolerant of fat, I don’t think it is the answer to our quality challenges primarily because more fat means more costs for both producers and packers. Color, ultimate pH and water-holding capacity (which are really three ways to say the same thing) are the keys to adding value back to these cuts that should be our flagships. What have you done lately to boost these values?

For more information and cited story source: https://www.nationalhogfarmer.com/marketing/what-have-you-done-lately-boost-cutout-values

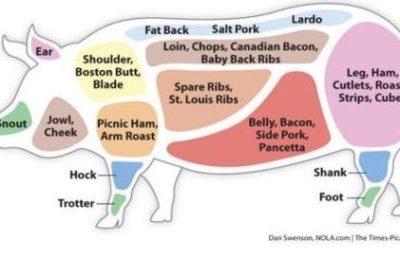

Picture source: https://www.nola.com/food/index.ssf/2014/11/reader_shares_recipe_for_pork.html

Categories: Uncategorized